|

|

|

Capture The Moment: FirstKnow.It

|

|

|

|

The Financial Crisis on FirstKnow.It

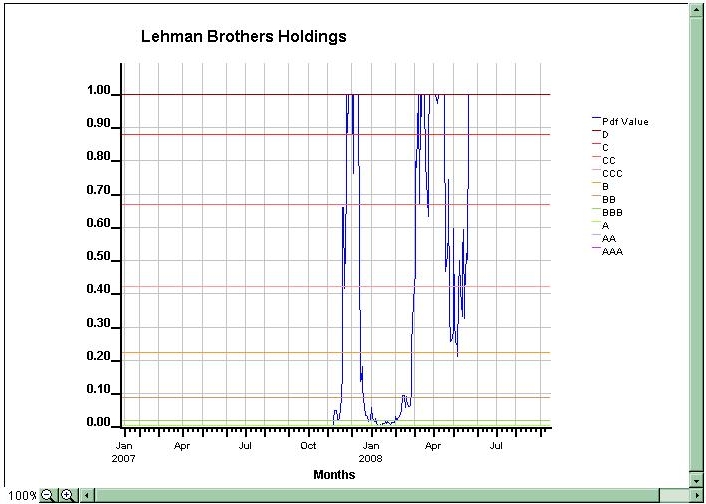

The collapse of Lehman Brothers was the largest financial collapse in US history. At the time of its collapse Lehman was rated A2 by Moodys and A by S&P. The following chart shows the 5-year default probability for Lehman with a default probability of 1 being theoretical bankruptcy.

|

Investment banks are extremely leveraged entities and rely on asset stability to achieve a high credit rating. Pre-crisis, Lehman had $11 of liabilities for each $ of equity capitalization (market leverage 11x) and its asset volatility

was about 2.7% (by comparison, Dow Chemical has $1 of liabilities for each $ of equity capital and asset volatility about 15%).

The extreme leverage makes investment banks very susceptible to big increases in market instability and in December 2007 Lehman's asset volatility exploded

from 2.7% to 4.25% as shown in this chart. From March 2007, Lehman had expanded its liabilities by 40% and its equity capitalization declined 25%

as shown in this chart. This almost doubled its market leverage to $21 of liabilities for each $ of equity capitalization. The extreme leverage and volatility spike rendered Lehman theoretically

bankrupt on the FirstKnow.It system for the first time.

By the time Bear Stearns collapsed in March 2008, Lehman's stock had deteriorated further, increasing market leverage to $24 of liabilities for each $ of equity and despite moderated volatility the

enhanced leverage again rendered Lehman theoretically bankrupt. Despite some equity recovery after the Bear Stearns rescue, from May 2008 Lehman's equity capitalization continued to collapse and from 22nd May 2008 onwards the bank was theoretically bankrupt on FirstKnow.It,

almost four months before its collapse on 15th September 2008.

The FirstKnow.It system predicted every significant bank failure in the US by several months. The following links show the FirstKnow.It 5-year default probability for the major failures: National City failed October 2008; Wachovia Bank failed late September 2008; Washington Mutual also failed late September 2008.

The biggest success was in October 2007 when the FirstKnow.It system predicted the failure of Bear Stearns, five months before it failed in March 2008. Federal Reserve Open Market Committee (FOMC) minutes show as late as December 11th Ben Bernanke foresaw "no insolvency or near insolvency among major financial institutions" and in "Hank: 5 Years From the Brink" Treasury Secretary Paulson says " As we moved into 2008 ... None of us understood the extent of what we were dealing with". In October 2007 there was not even the beginning of an idea

that there might be a significant crisis in 2008. Even late in Q1 2008 analysts had not begun to recognize the magnitude of the oncoming crisis; MoodysKMV's default probability mapped to Baa3 (investment grade) on the day Bear Stearns failed. This demonstrates the quantitative grounding of the FirstKnow.It system in mathematics and market data entirely without reference to opinions or perceptions. Bear Stearns failed 16th March 2008.

The financial crisis is usually characterized as a "2008 event", but on the FirstKnow.It system the risks were fully recognized in 2007. This link is an analysis which compares the aggregate asset-weighted default probability for the top 60 US banks and maps the default probability (red line) to the FOMC meeting transcripts for 2007. In January 2007 the aggregate default probability mapped to a AA- credit rating and the first negative sign

was in early March 2007 when increased default probability of major banks led the aggregate default probability to map to an A rating.

The crisis proper began on 20th July 2007 when aggregate default probability moved definitively below the A rating. From that point, rising volatility and declining equity capitalization saw rapid deterioration in default probabilities: by mid September aggregate default probability deteriorated to a BBB rating, late October to BB and by mid-December when Chairman Bernanke's verdict on the US banking system was that it was safe,

aggregate default probability had deteriorated to a CC rating. At the end of 2007, the FirstKnow.It system fully reflected the risks to the US banking system, three months before they became widely apparent with the failure of Bear Stearns.

|

|

|

|